Two million kids voted in the Kids Pick the President mock elections and they nailed the outcome. (that’s 4 out of 5 of the last Presidential elections, per Nickelodeon news) Now, Consumers Union is getting out the vote AGAIN, this time for a cartoon contest for credit card reform on a one month timeclock: Nov. 5-Dec. 5, 2008!

Two million kids voted in the Kids Pick the President mock elections and they nailed the outcome. (that’s 4 out of 5 of the last Presidential elections, per Nickelodeon news) Now, Consumers Union is getting out the vote AGAIN, this time for a cartoon contest for credit card reform on a one month timeclock: Nov. 5-Dec. 5, 2008!

Dangers of Debt Cartoon Contest uses a “crowdsourcing” submission approach to illustrate how credit card companies and student loan lenders “prowl for youthful customers to increase their profits.” (their words, not mine, honest)

Student artists sent in entries by Nov. 3 for a chance to win a grand prize of $1000 (that seems to be the magic number in these youth competitions) and now they have a month to pull out all the stops, using media and marketing to ‘vote it up’ among parents, friends, anyone who will participate in this “fiscal fitness” exercise. (You can vote your top 3 here)

Purpose? To raise awareness on how to avoid debt (gee, can the government play?) by using ‘forward to a friend’ peer to peer humor for education among students revealing the dangers of debt through easy credit.

“Young adults from across the nation portrayed how their generation is dealing with the current debt crisis, made worse by massive student loans, multiple credit cards and spiraling interest rates,” wrote Consumer’s Union. Evidently, student loan debt has doubled in the past decade, with the average graduate carrying a $19,200 school bill, and one quarter of college graduates leaving school with $5,000 in credit card debt. Ouch.

Credit card reform is already underway (passed in the House, headed to the Senate) to stop credit card companies from randomly hiking interest rates on credit card balances, changing the terms of agreement until the card’s expiration date, charging extra fees for phone and online payment, and marketing credit heavily to college students.

As the Consumers Union contest conveys, now more than ever, it pays to pay attention in this opportunistic environment due to extra-pinched vulnerability.

“With the economy crumbling because of the collapse of the lending industry, more and more college students and families are taking out larger private loans in order to cover skyrocketing tuition and other college costs. Credit card companies on virtually every college campus are luring young people into debt that could spell financial ruin at a young age. The dangers of debt are more real than ever before.”

“We shouldn’t pay higher interest rates and fees because banks need to make up for their losses and their irresponsible underwriting practices over the last decade,” wrote Consumers Union. Indeed. So what SHOULD kids do?

“We shouldn’t pay higher interest rates and fees because banks need to make up for their losses and their irresponsible underwriting practices over the last decade,” wrote Consumers Union. Indeed. So what SHOULD kids do?

Teens and youth can peruse some of the fact sheets and advocacy avenues to know their rights, below. They also offer ‘take action tips’ via their campaigns. (see links after related resources below)

As for the cartoon contest itself, the submission that gets the most votes wins $500, and the Grand Prize itself will be awarded by illustrators and artist judges for $1000. (students can’t win both categories!)

So far, the cartoon at left, showing how debt can literally snowball is in the lead…complete with ski slopes conjuring visions of students’ winter break plans to curb the ‘powder’ wanderlust of snowboarding wannabes itching to over-extend a tad…

Title? “Loan Mountain.” (I could make a ‘Brokeback’ debt joke, but I’ll leave it be)

I’ll jump to a couple of core credit card questions on the marketing and branding front with kids:

What’s your opinion of bank-sponsored programs that seed financial literacy for very young kids? Fair or foul?

Here’s the context: One example might be this Nickelodeon news story promoting the “Capitol One/Junior Achievement Finance Park” program which simulated a day in the life of a parent to “teach kids how to live within their means,” using life skills, computerized budgeting and hands-on role play.

Here’s the context: One example might be this Nickelodeon news story promoting the “Capitol One/Junior Achievement Finance Park” program which simulated a day in the life of a parent to “teach kids how to live within their means,” using life skills, computerized budgeting and hands-on role play.

It tells of heartwarming teaching moments with a 13-year old’s realization “Life on a budget is hard” and ends with “I’m going to give my mom a big hug and tell her I’m sorry,” …”Because we ask for so much stuff.”

At first glance, I’m all over it, since Shaping Youth uses hands-on simulations and demos to convey our points all the time…but then the marketer in me kicked in thinking, ‘Hmn…Is this an attempt to instill financial literacy funded by a bank sponsor or is it merely brandwashing at ever earlier ages and stages?’

Thoughts? Differentiators? Qualifiers? Caveats?

Believe me, I have very mixed emotions here, and firsthand experience too.

Believe me, I have very mixed emotions here, and firsthand experience too.

I was on the initial branding team of VisaBuxx prepaid cards for teens once upon a time, and as you can see by our initial campaign created here, I really viewed it as ‘financial education’ versus ‘seeding a brand.’

Lo and behold, when the member banks didn’t support the program in any big way, and Visa didn’t go to the mat to fund it with their bazillion dollars of marketing, it felt a bit ‘icky.’ I mean, there I was branding my little heart out, thinking this would help kids learn boundaries WITH parents using PREPAID cards to PREVENT credit card companies mining college kids for debt-saddling opportunities in “too good to be true” mode.

I have no bones to pick with VisaBuxx, I love the concept and the program itself, and I realize they were nickel and dimed by member banks and the numbers and fee-based caveats just weren’t working for them.

I have no bones to pick with VisaBuxx, I love the concept and the program itself, and I realize they were nickel and dimed by member banks and the numbers and fee-based caveats just weren’t working for them.

But still, here’s a big player on the branding front capable of funding this program fully to halo as the GOOD guys and TEACH kids money management from the get-go using a prepaid so they will NOT get into debt…Why not DO it? Well…er…

Revenue generation via preventive education is probably discordant, and I admit I’m Pollyanna to a fault at times. (ah, but those rose-colored glasses are so lovely!)

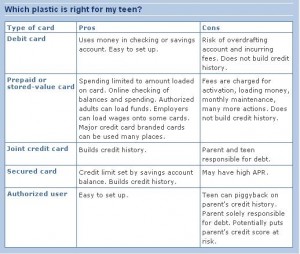

Still…as this table shows (from BankRate.com) we’re living on a “plastic planet,” the key is to educate kids on the ‘swipe-n-sign’ nuances long before they hit the homefront of peer perpetuation…

Their article was very informative, comparing, contrasting and DEFINING the different options and training tools: (debit, prepaid/stored-value, joint credit card, secured credit card, authorized user, etc.)

“Getting a credit card is a rite of passage,” says Todd Mark, director of consumer relations for Consumer Credit Counseling Service of Greater Atlanta. In fact, a 2005 study by the Jump$tart Coalition for Financial Literacy reveals that 31.8 percent of high school seniors use a credit card. About half of these students have a card in their own names and the rest use cards issued in a parent’s name. And of course, college freshmen get bombarded with credit card come-ons as soon as they set foot on campus.

Facing this prospect, plenty of debt-dubious parents wonder how best to introduce kids to the temptations of swipe-and-sign. As with most child-rearing decisions, the best course of action depends on the individual child. But thanks to an ever-increasing number of credit and debit options, savvy grown-ups can choose the card best suited to a teen’s temperament, financial sophistication and maturity level.”

Okay…and what happens when that ‘savvy grown-up’ is the feds, who can’t pull their OWN backsides out of a mountain of money mayhem?

I’m speaking of the FTC’s brand new “virtual mall’ that uses casual gaming as a way to impart “basic consumer and business concepts to young shoppers” to kids under age 12.

I’m speaking of the FTC’s brand new “virtual mall’ that uses casual gaming as a way to impart “basic consumer and business concepts to young shoppers” to kids under age 12.

I haven’t jumped into it yet fully, other than a surface skim for media literacy and financial acumen so I’ll reserve judgment, but it does beg the question…

Is this a “crash course in capitalism for beginners” (great Ypulse piece here) or is this an attempt to instill basic supply and demand concepts of Econ 101?

Is it simply a parenting tool to add to the media literacy war-chest or another plop ‘em in front of the computer gizmo to usurp parental obligation for imparting financial budgeting and fiscal responsbilitity in REAL life, first hand…Through…gee, I dunno…personal engagement? Old-fashioned chores, privileges, budgets, job jars, allowances, money management?

I’m not dismissing informal learning, virtual games, or any other fun tool to impart fiscal responsibility…not at all. I remember playing a board game with my brother called “Stock Market” that taught me more about Wall Street than any econ class ever did. And to this day, I credit my geography grade to Risk and my ability to understand office politics to Stratego. I’m a big fan of informal learning, yessirree…

But I’m just trying to get a handle on the who, how, why, and what factor here so that I can assess and mitigate my OWN somewhat loaded reaction.

After all, our country has been cramming the consumption-driven ‘buy, buy, baby’ notion down the throats of kids from the get go, and deregulation has given media and marketing a complete hallpass to mine kids’ childhoods directly…

After all, our country has been cramming the consumption-driven ‘buy, buy, baby’ notion down the throats of kids from the get go, and deregulation has given media and marketing a complete hallpass to mine kids’ childhoods directly…

So somehow higher level consciousness within the FTC seems a wee bit belated, and a tad manipulative to boot. But maybe I’m just too close to all this…

What do you think?

Have you had ‘debt’ discussions in your home?

At what ages and stages?

Do you feel educated about credit? Teens? Adults? Collegiate crew?

Where do you stand on sponsored platforms for fiscal or media literacy? Are you savvy about ‘zero interest’ starter deals or do you fall prey to ‘free’ credit cards?

I’m sure the Ypulse gang back east is addressing this in their live-blogging taking place right now at their youth conference in some capacity…Advertisers have all been clamoring to figure out ‘what the financial meltdown means’ on the familial front, so I’m sure it MUST be top of mind in spending strategies for the holiday season and beyond.

Once again, I hope the media and marketing industry will see this as an ‘opportunity’ to self-rein, reprioritize, and act responsibly during these vulnerable times, rather than ‘cash in,’ clean up, and mine the short-sightedness of ‘selling kids on credit.’ Judging by these student debt cartoons, it’s ‘no laughing matter.’

p.s. Don’t forget to vote! (and read the student synopsis of each cartoon, it really delves into the whys of the students’ creative vision)

Here’s a sample of one student entry called “Real Life”:

The artist explains his inspiration, “Its a beat up car with a student driver sticker on it. They are at a fork in the road with a no u-turn sign. The road is crumbling behind them so there is no way back, all the roads say one way. To the left is a new car dealership, the signs read “$NEW CARS$” “0% DOWN!” “BAD CREDIT, NO CREDIT, NO PROBLEM”. Straight ahead is a “$UNIVERSITY$” with a banner that reads “GREAT DEALS ON STUDENT LOANS”. On the right is a new house with signs that read “FOR SALE” “GREAT RATES”. The chimney has smoke in the shape of a dollar sign because houses burn through money. In the dark woods are eyes peering out at you. Under the eyes it says “CREDIT CARDS” on the left, and “BANKS” on the right. Really wish you could see it better, it works better when you see it and I am not describing it.”–by ‘New Jack’

Related Resources on Credit Crunch

Kids Take Lessons From National Debt Binge (Shaping Youth)

Educating Teens About Credit (BankRate.com)

How to Teach Your Children About Credit Cards (BankRate.com)

Students Learning From Financial Crisis (SFGate 10-26-08)

Card Issuers Target Teens (BankRate.com)

A Case of Balance As Credit Card Rules Change (SFGate 10-26-08)

Why Credit Cards Are Getting Away With It (Sec’y Labor Robert Reich)

The Next Crisis: Credit Card Debt? (ABC News 3-08)

Will Credit Card Debt Be the Next Financial Crisis (Chron Higher Education)

Generation Debt (book) and Generation Debt.org: Student Loan Consolidation Legislation

Consumers Union Fact Sheets & Tips

- Are credit card companies slinging credit cards on your campus?

- Have you paid large fees when you overdraft your bank account?

- Perhaps you are one of the many college students that have been saddled with large student loans with undesirable terms.

- Have you, someone you know or a family member received a mortgage loan which has become a financial burden? Get the inside scoop on financial privacy and identity theft legislation and other issues affecting your wallet: The Daily Dollar –

Shaping Youth Links List: Financial Activities for Kids, Teens, & Youth

JumpStart.org: National Financial Coalition; Reality Check for Kids

Global Stock Market: Free, realistic game simulation

Moneyopolis: Online game; probono effort by Ernst & Young for middle schoolers

LifeSmarts.org: National Consumers League/high schoolers

Independent Means website & products by Joline Godfrey, including Raising Financially Fit Kids, No More Frogs to Kiss: 9 Ways to Give Economic Power to Girls etc.

New Moon Money: Book written by girls for girls, from New Moon Publishing

Save for America: School savings curriculum w/online integration

Moon Jar: Award-winning financial literacy toolkit, book, products

Hot Company: “The money game with attitude”

Prosperity4Kids: Financial training products, programs & tools with resource links

Kids.Gov: Official Kids Portal for the U.S. Government on all things ‘money’

Sense & Dollars Online game; middle/high schoolers

Minyanland: Bulls/Bears and virtual critters teach money tips (w/NCEE)

iThryv: Newly launched online banking site for kids by Shryk.com

Related Resources for Kids’ Financial Literacy

My Reward Board: Virtual Chore Chart Boosts Kids’ Financial Savvy

Powell Center for Economic Literacy (An economic Romeo & Juliet)

When Tough Times Weigh on the Kids (WSJ Online 9-24-08)

How to Discuss Financial Woes With Children (CreditCards.com/USA Today)

How Young is Too Young for Credit Cards (note source: Credit Cards.com)

Kiplinger’s Money Smart Kids (article compilation)

Financial Literacy for Kids: Money Lessons Should Start Young (Parenthood)

Girls Inc: Economic Literacy (for adults too!)

Creative Wealth International (formerly The Money Camp)

Financial Smarts for Students: The JumpStart Coalition

Visual Credits: AP wire (link earlier ) on credit card montage photo

p.s. David Jones, CEO of PAYJr. just left a note on the blog, kind enough to clarify their role with Visa Buxx, and red-flag some of the BankRate.com info re: PAYJr. is outdated. So I’m adding his ABC news interview here which frankly, brings up some interesting topics we’ll delve into deeper next time re: prepaid cards, parental controls, online chore tracking w/financial rewards etc.

Example? When he entered $.50 to feed a pet EACH time 3x per week, the system made him increase it to $1…um, the privilege of HAVING a pet is reward itself, I’d like to look into how some of this immediate gratification is ‘training’ kids for entitlement, personally…Also concerned about the ‘ad creep’ into schools based on his comment re: PAYJr. potential for lunch card use in school districts and such…again, this brings up the question of corporate motives over kids’ financial literacy. Fine lines and blurry boundaries that need addressed.

I think teens – and pretty much everyone else – should pay for stuff with good old fashioned CASH.

When it runs out – it’s time to work more or stop buying stuff.

There is a Capitol One logo on our town’s high school sign. Is it any wonder that kids are going bankrupt in college? We’re letting credit card companies misinform consumers starting with letting them advertise in math text books and on high school stuff.

It doesn’t take a genius to figure out where it will end. As consumers we need to say NO!

Well, that answers my question on ‘how you feel’ about Capitol One and/or corporate encroachment into the school sphere, eh?! 😉

THAT is my conundrum in terms of discerning ‘brand management’ and infiltration into the youth sphere. Is it ‘EVER’ productive if the corporate purse strings are aligned, or no?

For example, I’m planning on asking that very question to David Jones, CEO at PAYJr. in an interview soon, because he definitely took issue with the framing here…And says,

So I’d like to hear from all sides of this debate…industry, parents, nonprofits, CSR, government, kids themselves.

Sound off people!!

Let’s get some dialog ramped up here to better understand the many issues on the table!!! 🙂 Thanks so much, Tracee for taking the time to comment…Back atcha soon, –a.

Also, folks, I’ll be doing a follow up piece on consumption cues and the holidays soon…but check out Tracee’s series on same, as well as this one on ‘boycotting Christmas in June’ that merits a peek:

http://www.blogfabulous.com/boycott-christmas-in-june

Her series on ‘meaningfully frugal’ gift giving is cool:

http://traceesioux.blogspot.com/2008/10/christmas-tip-1.html

http://traceesioux.blogspot.com/2008/10/meaningfully-frugal-christmas-tip-2.html

http://traceesioux.blogspot.com/2008/11/meaningfully-frugal-christmas-tip-3.html

Will post about it soon, as I’m doing a piece on ‘the stick’ entering the Toy Hall of Fame…and am busy ‘branding’ it to metaphorically ‘sell’ to kids. 😉

Only in advertising, eh?

From the office of Senator Barbara Boxer, Ca.

Some great fraud tips along these lines re: credit/debt:

“While many people are struggling to make ends meet in these tough economic times, some people are responding with criminal schemes that take advantage of others. Many law enforcement agencies report an increase in the number of reported scams and fraudulent schemes. The timing of this increase seems to correspond to our nation’s deepening economic struggles.

The Federal Bureau of Investigation has two website features that offer tips on ways to ways to both identify and avoid scams. You can find the FBI’s tips on fraud schemes at http://www.fbi.gov/majcases/fraud/fraudschemes.htm

The FBI also has some helpful tips for seniors, who are often the targets of scams. That feature may be found at http://www.fbi.gov/majcases/fraud/seniorsfam.htm

I strongly encourage you to look over the tips offered by the FBI and share them with people you know who might be the targets of scam artists. More than anything, caution is advised when offered any new product, service, prize, or deal. Sadly, our difficult economic times seem to have encouraged these criminals….”

etc. etc.—Check the links!!

Forewarned is forearmed!

Hi Amy

I am really happy to stumble across your blog/website. I am in the process of publishing a humor book, “Ooh Baby Compound Me,” comparing credt card companies to fraternity hazing. In a dark, humor (frat boy) tone outlines consumer spending habits, creditor habits, solications and the fine little print contract that no one reads. I believe humor is the best way to address this topic…

For me, consumer responsibilty is just one issue. The other, is the responsiblity of creditor who although want to give us great deals, benefits and teach us, but the bottom line they are still seducing the consumer with more spending ideas. Bottom line, they want us in debt.

I believe especially in this day and age, the credit corporations need to be responsible.

Please visit my website…It is a bit darker, then your approach. But same message is being protrayed.

Hey Jennifer, your seduction analogy is a good one; parent readers, give it a look see…some pretty hilarious intentional correlations taking a ‘sex sells’ satire applied to the dangers of debt…

That said, since we always try to cover all views, I’m pleased to announce we’ll be interviewing the CEO of PayJr and Visa Buxx with some pointblank, very direct questions and I’m eager to hear the responses on same. (that’s what makes Web 2.0 a dialog rather than a monologue!)

Stay tuned!!

So stay tuned, and I may

It’s so unfortunate the way we have been commercialized and how our children are being programmed for a life of consuming, and towards so much of the wrong things. If children are allowed to be ‘brainwashed’ in any way it should be towards living a healthier and happier life. And parents should not be left alone to fight the huge tide of marketing that promotes and persuades children in the wrong direction.

What a worthwhile effort – your blog Amy.

My grandparents are all looooooooooong gone…but Wow, ‘Grampa Ken’…you can be my surrogate Grandpa any ol’ time, I just checked out your site and you ROCK as the kids say!!!

Readers, check him out…Part philosopher, self-help inspiration, buddha style calm and sage wisdom his words resonate with me and validate the moral imperative that we get KIDS to CONNECT with seniors often and substantively…

Kids NEED the guidance and grounding of ‘the greatest generation’ more than ever right now, and I implore any and all to freshen your worldview, Windex the lens of your camera of life, and see what each generation brings to another, as it could be the key to some of the solutions we’re seeking by leveraging collective knowledge for good!

Here’s another community along these lines that I recently found, which has a whole series of blogs, forums, relationship connectivity and such around grandparents and the lessons we can all learn!

http://www.divinecaroline.com/browse/relationships/family/grandparents

Hug your Grampa today if you have one!!! 🙂

Thanks Amy. I’d love another granddaughter, like you.

Keep up the wonderful work.

Ken

Amy, thanks for the invite to comment. Here in the UK it is not usual for universities to have relationships with credit card companies. This seems to be common in the US and, in the end, not a good thing–like having a soda / vending machine monopoly on campus, only worse.

Good for the university but not good for the students’ health / financial health. I’m surprised not to have read of the development of a code of ethics that universities should adhere to in such matters (which doesn’t mean it doesn’t exist). Transparency would be a good principle to see espoused.

It seems to be a universal fact of life that those least able to pay pay more. In the UK the energy companies currently charge higher unit costs to people so poor that they use coin meters–and they will be prosecuted by the govt. if this isn’t stopped. But the principle appears everywhere and nowhere more than in the interest rates people pay on debt. Yes, riskier debt should cost more, that’s a business fact of life. But cynical financial entrapment of the unwary is another matter and no legislation will ever entirely eliminate that.

A colleague once told me that he had no worries about one of his kids getting into debt while at university. His son was working on a telephone helpline for people in debt. It was, apparently, a priceless education.

My own wake-up call on that score came at the age of 12 when I discovered from reading an annual mortgage statement that my father’s mortgage debt INCREASED despite his making all his payments on time–he was running to stand still but ended up going backwards. Money was tight and that made quite an impression on me, enough to make me committed to owning my own home outright ASAP. As result of being a homeowner with no debts I can now afford to go back to university for another degree, just because I feel like it, and I’m not borrowing to do it.

Conflict of interest is an idea that students need to grasp and if they can’t … heaven help them. The cartoon image that comes to mind in the context of the discussion above is foxes putting up posters for a workshop on the care and feeding of chickens.

What a brilliant and worthy snapshot of the differences over the pond (and yah, I wondered myself why someone didn’t create that cartoon as the most obvious a+b=c equation!)

The policies and info you bring forth are a huge issue for us here in the U.S. and though we’re seeing tightening of the “easy credit” pursestrings, it’s to benefit the financial institutions liability far more than the students being impacted. (the ‘infomercials’ in the wee hours of my insomnia the other night seeking a CNN fix floored me with the amount of ‘we can help you’ style of debt-consolidation pitches…which is incredulous to me…(gee, yes, let’s target people up in the wee hours of night shifts or less than ideal sleep deprivation timing to pitch credit fixes and mine human vulnerabilities of financial stress. sheesh.)

Anyway, I’m about to try out the PayJr. online tool right now with my 13 year old to test out some of the media literacy conversations early on…

btw…Reading a mortgage statement at age 12? Wow. How can we instill ‘aha’ moments like those in kids early on? The ‘Capitol One’ program using the ‘day in the life’ simulation of kids taking on the roles of parents seems like a good start, but again…my ‘fox/henhouse’ meter is on red alert w/that one due to the brandwashing and CSR conflict of interest there via Nickelodeon demographics.

And you’re a ‘homeowner with no debt?’ I believe that’s pretty oxymoronic in itself here in the U.S.!! (other than some senior/retirees and a handful of .com millionaires I can’t think of any middle class families who reflect same)

Most impressive…

Any tips you can give youth/parents/educators for best practices to deploy here?

I think the most valuable thing anyone can get from others one likes or respects (family, educators, whomever) is the permission or the power of example to resist the herd and its instincts. Some are born with the instinct and are naturally contrary.

Having taken a marketing class as part of my MBA studies I had to read about how companies were dealing with increasingly canny and well informed consumers (stealth marketing, product placement etc.). There’s no reason that consumers and advocates can’t use the same techniques and technologies. Barack Obama’s election was in a large measure a result of his being on cutting edge in employing Internet technologies. So… the tools are there, waiting to be used, and at virtually no cost. Valuable brands can be built from ostensibly contrarian wisdom too. Motley Fool is a great example (and may be a partner worth working with?).

I think all kids struggle with feelings of being the odd one out, and whenever they feel that need some validation. Right now there are some very topical cases. To take one:

All kids should know what a Black Swan event is. Nicolas Taleb’s books: The Black Swan (available here: http://www.scribd.com/doc/5574943/The-Black-Swan-The-Impact-of-the-Highly-Improbable –I have no idea if this web copy is kosher or not) and Fooled by Randomness contain some great material that would appeal to any kid who wants to reject keep-up-with-the-consumerist-next-door pressures.

In terms of financial education the lesson of overriding importance seems to be the value of delayed gratification. If you Google “marshmallow test” you’ll find some interesting stuff. This is a nature v nurture issue and it should be pretty teachable.

By now all kids are very aware of the rate of change of technology. So they have a choice

1. Buy today’s iPhone (or whatever) on credit and pay twice over, or more

2. Wait a bit and buy a superior product costing half as much with cash

Give them WWWBD ideas (not bracelets, please) — What Would Warren Buffet Do? Or, for that matter, Barack Obama’s grandmother.

I had a finance lecturer who could wax entertaining, at length too, on the subject of those 2AM commercials. As a late mid-career MBA student from the not-for-profit world you can imagine how entertaining it was being educated, too, on the accountant’s answer to “What’s 2 + 2?” (A. What do you want it to be? A2. And here’s how it’s done, entirely legally).

It didn’t take a rocket scientist to understand a one page financial statement showing that my Dad owed more money at the end of the year than he did at the start. He reduced the debt month by month and then a single line reading “interest” knocked him back more than a year. Even children have a natural sense of fairness, and the idea of his making no progress whatever was a shock — mainly because I knew he was struggling to pay school fees, so this was an added difficulty.

I was happy to find your blog – thanks for sharing your information (I love the cartoons – what a great idea!)

good post to educate young people nt to get into debt. If u want sumthing buy it and pay frm cash. DOnt use cards. It will ultimately get u into debt

[…] Shaping Youth » A Humorous Approach to Student Debt: Credit Cartoons […]